Entering the Maritime Sector: Logistics 4.0 - Revisited

Brownfield automation has the future

Although container terminal automation was until recently solely reserved for the high labour cost countries, recent development in Indonesia and China show that large-scale terminal robotization will be the new norm for new greenfield sites. When the current wave of RMG-AGV terminals has come up to speed, these designs will be the template for new developments. However, the space for new developments will become less, subject to increasingly stringent environmental regulations. This means that the application of automation and robotization will increasingly become the domain of existing sites, where new technology is implemented. Two types can already be recognized: automation of straddle carriers, and automation of RTGs. The first already proven at 2 sites in Australia (Brisbane and Sydney), and under development in Auckland, with many others in deep investigations.

In RTG terminals – the predominant handling system worldwide, with approximately 70% of sites operating with RTG in combination with Terminal Trucks (TT) – the implementation of robotization is more difficult. Road trucks penetrate deeply the yard, and mix with internal trucks, complicating automation of equipment. Yet, with the rapid deployment of technology in road trucks (see the recent 200 miles drive of an unmanned truck in the US), the combination of semi-automated road trucks and automated internal trucks with automated RTGs comes within reach. We expect that the deployment of this type of robotized handling system will keep the terminal industry busy for the next 2 decades. Improving safety, efficiency, and service levels of container terminals.

The steam engine. Electricity. Automation. The Internet of Things: these 4 terms describe the evolution of industrial progress in roughly the last 2 eras. The Internet of Things – also addressed as the fourth wave in industrial development, or as the ‘digitisation’ of industry – offers various opportunities to the port sector. Machines, devices, containers, trucks and even infrastructure have the potential to become intelligent: each element along the logistics chain carries vital information regarding destination, purpose and specific contents. What stands out most however is the large scale robotization that recently took place in Rotterdam, Sydney and LA/Long Beach.

Since the early nineties, terminal operators have been working on robotising equipment at their facilities, and with the recent openings of new facilities at Maasvlakte II (2 sites), Sydney and LA/Longbeach (2 sites), the capacity of robotized terminals increased by close to 10M TEU, reaching an all-time high. Besides, in China, 2 major developments are under development, in Qingdao and Shanghai (Yangshan IV) bringing another 10M TEU of robotized capacity. With this major step towards large-scale robotization, and the increasing technical capabilities, should we expect others to follow quickly, or will another period of stunted development take place? After all, it is also noted that is takes longer than anticipated to bring these terminals to the targeted levels of productivity. Other questions that arise, also under the consideration of stagnating growth are: what are the social impacts of on-going robotization, what are the technologies available, has integration reached a level of maturity, or are projects still ‘state-of-the-art’ in the worst sense? This paper addresses these issues, but firstly it is important to explore other forms of automation.

Process automation

This category of automation contains technologies that typically replace clerical labour such as identification, inspection, registration, and similar tasks. The most common application is gate automation, where truck and container, and increasingly damage and seal presence are automatically identified and registered. It is also quite common for position detection systems (PDS), which assist the terminal operator in locating containers and equipment, to be part of the process. Position detection systems are one of the largest scale applications of the Internet of Things. Simple ‘tags’ are added to vehicles, chassis, and readers are placed in strategic locations, also outside the terminal, to enable early notification of arrivals. Both types of technologies have been successfully implemented and are offered by a broad range of vendors.

Making containers ‘visible’ in real-time is a likely next station, as several container tags have been developed, yet being withheld by the cost (after all, 20 million containers would need to be tagged), and on-going maintenance. Yet the benefits in the supply chain are obvious, and would also make OCR technology largely obsolete. If trucks and containers have their identification details broadcasted at any point in time, finding out which truck and container are at the gate becomes superfluous. The same applies at the quay, where recently crane-OCR has taken a giant step forward. Container tagging would also make this technology obsolete, apart from damage registration.

Further process automation enabling technologies on the brink are electronic seals, which can be expected to overcome the necessary seal reading.

Automated decision-making

Another category of automation that needs to be mentioned is automated decision-making. Here, another hype word is present; big data. Fostered by the interconnectivity of things, more and more data is being collected, which facilitates data processing which in turn leads to quicker and better decision-making (at least in theory).

A recent analysis by McKinsey indicated that less than 1% of data gathered is actually used. A wealth of data about the supply chain could largely improve the efficiency of terminals: lesser unproductive work, lower dwell times, faster vessel handling, all driven by intelligent use of data. A recent article by Oscar Pernia from NAVIS goes in-depth with regard to the use of big data in terminals and supply chains.

Yet despite availability, and rapid reduction of cost, new technology is slowly adopted in the maritime industry. The valid question is why? We see terminals invest in an additional berth – with 4 quay cranes and associated yard equipment – but not in technology that increases terminal capacity or efficiency by the aforementioned benefits. Where the implementation of technology is slow, the embracement of robotization is even slower, and is still by many seen as a white elephant.

At first glance, robotization appears to have so many advantages: it replaces heavy, dangerous and repetitive work – clerical functions are much lighter. All the more reason to implement robots. In other industries, the penetration of robotization is much higher.

We have to see the introduction of such technologies in the context of terminal operations, which can be characterized as highly dynamic, or even, unpredictable, poorly planned, and erratic. This is caused on the one hand by the poor information basis underlying terminal operations. It remains remarkable how much container information changes when a container has arrived at a facility. On the other hand it is process interconnectivity, causing one process disturbance to have ripple effects on other processes. We will come back to this issue later, when we discuss the importance and complexity of integration. In the next sections, we will try to answer the questions raised in the first section.

Implications for the sector

Generally, automated terminals offer a more stable level of performance at a lower cost than their conventional siblings. Ask shipping lines and they would name CTA (HHLA) and Euromax (HPH) among the best terminals in Europe, if not the best, maybe with the exception of several high-performing terminals in Antwerp. Not only do they offer more reliable service levels, they are more cost-effective, work 24/7, and are less sensitive to high occupation rates (of the berth and yard). This means that other terminals face increased competition when one of their competitors – serving the same market – introduces automation, or develops a new automated terminal.

A good example is the semi-automated DP World terminal in London (London Gateway). It offers a high service level, high capacity, and is situated close to the hinterland. We expect that it will have an effect in the middle to long term on terminals such as Thamesport, Tilbury and Felixstowe; its main competitors.

A similar impact, or even greater, can be expected from the fully-automated terminal in the Port of Los Angeles/Long Beach, being developed by OOCL. The terminal will bring a substantial new chunk of capacity into a highly competitive market. The capabilities of the terminal in terms of handling speed and capacity are (by far) the highest in the port, and even on the entire West Coast of the US. Although not yet realized on the waterfront, the landside is already among the best on the entire Westcoast. Its cost base will be substantially lower than any other terminal on the West Coast of the US, also. Impact is imminent and guaranteed.

Social impact

When discussing automation we cannot go beyond the social question. The direct impact on dock workers is obvious and painful. We argue that here we have to take a broad and long-term perspective. First of all, the jobs that are being replaced are hazardous, repetitive and isolated. They are (partially) being replaced with office jobs, with no risk, and in a more social environment. Instead of spending a number of hours alone in a machine, people are together in an office carrying out operational tasks together.

Furthermore, new jobs are being created. Jobs that require higher education and better training, and jobs that are in general more attractive to a future workforce. Some studies even come to the conclusion that overall more jobs are being created than are disappearing. Also, one study indicated that 65% of the people that were losing their job could be retrained into new jobs.

Finally, the competitive edge of automated ports exceeds that of non-automated ones. As many ports are typically serving the same hinterland, an increase in capacity and efficiency makes ports more attractive, leading to more volume (in the long term), and if they do not, to a lesser volume. Therefore, not embracing new technology may lead to an obsolete port, and in the long-run, a larger loss of jobs.

This means that in practice we have to develop plans to make sure that as many people can be retrained as possible, which is always better than the long term perspective of a port that cannot compete anymore.

Available technology

In the contemporary era we are surrounded by technology. The same types of technology that enable the automation and robotization in ports also assist us in daily life. We think communication and location determination is easy, however we tend to forget that our cell phone regularly has no reception, and our GPS is regularly off by more than just a few meters. The batteries in even the newest devices do not last for more than a day, and the automated cruise controls in cars can only be used as driver’s support.

The precision, durability and reliability required for fully automated operations is still expensive and not yet commonly found off the shelf. Although it relies on the same type of technologies, the scale is much bigger (an AGV battery is about 5 times that of the largest electric car battery, the one of the Tesla S), the intensity is much higher (the equipment easily runs more than 5,000 hours per year, and then for 10 to 20 years, compare that to a road truck: it would mean a mileage of 3 to 4 million kilometres) hence the requirements for durability are much, much higher.

Finally, for reliable 24/7 operations, equipment and the processes really need to be automated. With no driver to correct the behavior of a robot in unforeseen circumstances – a recent report revealed that in the first 700,000 testing kilometres in (80) Google cars, the drivers had to intervene 341 times to avoid an accident; that means that without intervention, each car would have had an accident every 2,000 kilometres: not a good track record at all. Of course, automation on the public road faces many more complex circumstances than in a closed terminal environment, yet the last 10% of automation proves to be the hardest, mainly because of integration.

Integration

This brings us to one of the key remaining challenges in port robotization and automation: the integration of pieces of kit (that are typically supplied by different vendors). Integration is a challenge not only applicable to the port industry: it causes headaches in each and every sector. One of the factors here is the lack of standardisation.

Integration complexity worsens in the case of full automation, as the humans involved in the process can solve small inconsistencies and improvise when a robot does not behave exactly like it should. Other automated parts are less capable to deal with another device’s flaws. Machines operate (mostly) in a black and white fashion: wrong input means error, and error typically means “STOP”. When many different pieces of automated machinery come together, it easily leads to something stopping, causing the entire chain of processes to cease.

This makes integration across vendors and technologies a key area of attention to achieve success. Continuous dialogue, joint specification work, early integration testing, and rigorous, rich and dynamic test environments are necessary.

Standardisation of communication protocols, communication buses, and integrated test environments are the answers to this complex puzzle, and slowly but steadily, they improve the ease of integration. By no means is the industry there yet, and every new development causes new challenges. A key solution here is to copy working solutions, instead of trying to invent the wheel over and over.

What next?

APMT and RWG have taken a bold step forward in Rotterdam by substantially extending the scope of robotization. They have implemented remotely controlled quay cranes, fully automated horizontal transportation (battery-driven, with automated battery exchange station), fully automated stacking cranes, including fully automated truck handling (only incident handling by a remote operator), as well as automated transport to the rail terminal in the case of APMT.

We should not expect any further steps soon, other than more of the same. We expect to see several implementations of yard cranes in combination with automated straddles carriers for horizontal transportation (as currently being implemented in Melbourne). One development that needs to be taken very seriously is the automation of straddle carriers, and of rubber-tyred gantries (RTG’s). The first, because it does not require large investments in civil infrastructure to enable the automation. Replacement of the fleet of machines, or even automation of the existing machines is required, and the additional communication infrastructure is quite limited.

The second development is the automated RTG. As RTG yards have over the road trucks amidst them, robotization is tricky from various perspectives, with safety and liability as most important aspects. Several (brownfield) terminals are working on remotely controlled RTG’s, but a large scale terminal has not yet gone into operation. Avoiding conflicts between the road trucks and the remotely controlled RTG’s remains a safety risk. For now, we foresee that it will be limited to automated working inside the stack, and full remote control during the truck handling, as well as during the movement along the stack.

Conclusion

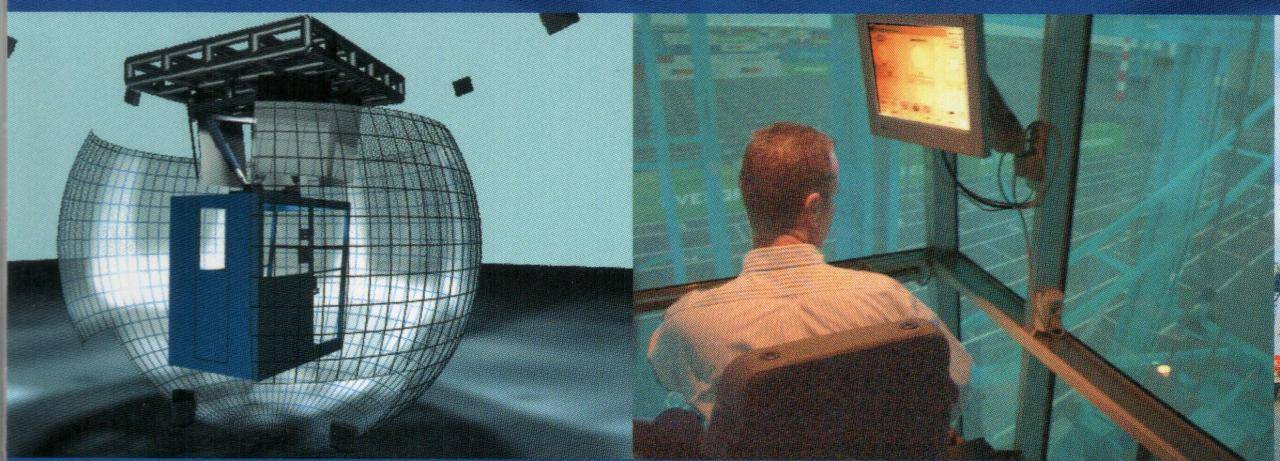

Automation and robotisation are the future for container terminals. The advantages simply outweigh the drawbacks. The associated investments, limited experience in the market, integration issues, social issues, and many other less important reasons will still cause terminal operators to choose simpler, quicker and more proven solutions. However, long term, container terminal operations will be robotised. The human aspect of automation should not be overlooked: on the one hand the social impact of a reduction in certain types of jobs. On the other hand the need for peoples with a new skillset. Process controllers similar to the process industry, able to deal with complex systems, and exception handling.

In a special edition of The Journal of Ports and Terminals (Top 30 Papers 2014-2016), an article on brownfield automation by Yvo Saanen that was originally published in Edition 69 – The Mega-Ship Issue has been updated.

Share this

You May Also Like

These Related Stories

Terminal Automation: Key Questions Answered

Human Machine Interfaces - the key to productivity?